In an unprecedented shift within the global automotive landscape, China has firmly positioned itself as the undeniable leader in the production and sale of luxury electric vehicles (EVs). This domination is not a fleeting trend but a calculated ascent built upon massive industrial investment, relentless technological innovation, and a deeply supportive governmental policy framework. While traditional European and American luxury marques are still navigating their electrification transitions, Chinese brands have surged ahead, capturing significant market share both domestically and in key international markets. This article delves into the multifaceted reasons behind China’s commanding position, explores the key players driving this revolution, and examines the profound implications for the future of the worldwide automotive sector. The narrative of luxury and performance is being rewritten, and the new authors are headquartered in China.

A. The Foundational Pillars of China’s EV Supremacy

The rise of China’s luxury EV segment did not occur in a vacuum. It is the direct result of strategic, long-term planning and investment across several critical areas.

1. Proactive and Sustained Government Policy: The Chinese government identified new energy vehicles (NEVs) as a strategic priority over a decade ago. This commitment was translated into one of the world’s most comprehensive and sustained subsidy programs for both manufacturers and consumers. While direct purchase subsidies have largely been phased out, the policy ecosystem remains robust. It includes stringent fuel economy regulations, aggressive quotas for NEV production (via a dual-credit system), and massive investment in nationwide charging infrastructure. This created a predictable and favorable environment for domestic companies to experiment, scale, and mature.

2. Complete and Agile Supply Chain Dominance: China controls a staggering portion of the global EV supply chain, particularly for batteries. Companies like CATL and BYD (which also produces batteries) are global giants, supplying not only Chinese automakers but also traditional OEMs worldwide. This vertical integration, from raw materials like lithium and rare earths to finished battery packs and semiconductors, provides Chinese EV makers with cost advantages, supply security, and faster iteration cycles. They are insulated from the global supply chain disruptions that have plagued other automakers.

3. A Digital-Native Consumer Base and Ecosystem: The Chinese luxury EV buyer is typically younger and more tech-savvy than their Western counterpart. They do not just purchase a car; they buy into a seamlessly integrated digital ecosystem. Chinese automakers, unburdened by legacy combustion engine architecture, design vehicles as “smart devices on wheels.” This includes advanced driver-assistance systems (ADAS), over-the-air (OTA) software updates, immersive in-car entertainment, and deep integration with popular Chinese mobile apps. The car becomes an extension of the user’s digital life, a feature that has become a primary selling point over traditional brand heritage.

B. Key Contenders Redefining Luxury and Performance

The Chinese luxury EV market is not monolithic; it features a diverse array of brands each pursuing a distinct vision of premium electric mobility.

A. BYD: The Vertical Integration Juggernaut. While BYD offers a broad range of vehicles, its premium brands, Yangwang and Denza, are making global waves. Yangwang’s U8 luxury off-roader exemplifies technological bravado, featuring a four-motor setup enabling unprecedented “tank turn” capabilities and blistering acceleration. BYD’s core strength lies in its self-sufficiency, manufacturing its own Blade Batteries (renowned for safety and density), semiconductors, and motors. This allows for superior quality control and innovation at a pace competitors struggle to match.

B. Nio: The Pioneer of User Ecosystem and Battery Swapping. Nio has built its luxury proposition not solely on the car, but on an unparalleled ownership experience. Its signature Battery-as-a-Service (BaaS) model separates the battery cost from the vehicle, lowering the initial purchase price. Owners can then subscribe to battery packs or swap a depleted battery for a fully charged one at automated stations in under five minutes addressing range anxiety directly. Coupled with exclusive Nio Houses (clubhouses for owners) and impeccable customer service, Nio sells a lifestyle and a community, creating fierce brand loyalty.

C. Li Auto: Strategic Range Extension for Market Success. Li Auto took a pragmatic, transitional approach that proved immensely successful. Its vehicles, like the popular L-series SUVs, are extended-range electric vehicles (EREVs). They feature a sizable battery pack for daily electric driving (typically 150-200 km) paired with a small gasoline generator that acts solely as a range extender to recharge the battery. This eliminates range anxiety completely, making them ideal for China’s vast geography and inconsistent charging infrastructure in some regions, while still providing a predominantly EV driving experience.

D. Xpeng: The Torchbearer for Advanced Autonomous Driving. Xpeng positions itself at the cutting edge of smart technology. It invests heavily in full-stack in-house development of its XNGP advanced driver-assistance system. With powerful onboard computing, lidar sensors, and a focus on AI-driven navigation-guided piloting, Xpeng aims to deliver the most sophisticated autonomous driving experience in the consumer market, directly challenging Tesla’s FSD. Its luxury offerings, such as the X9 MPV, are showcases for this technological ambition.

E. Traditional Joint Ventures Ascending: Zeekr and Aito. Leveraging the expertise of established giants, these brands combine global engineering with Chinese tech prowess. Zeekr, under Geely (which owns Volvo and Polestar), produces technologically dense and stylish vehicles like the Zeekr 001 shooting brake. Aito, a collaboration between Seres and Huawei, integrates Huawei’s formidable HarmonyOS operating system and ADS 2.0 autonomous driving system, creating vehicles celebrated for their seamless smart cockpit experience. These ventures prove the depth and collaborative strength of China’s auto industry.

C. The Global Expansion Strategy and International Reception

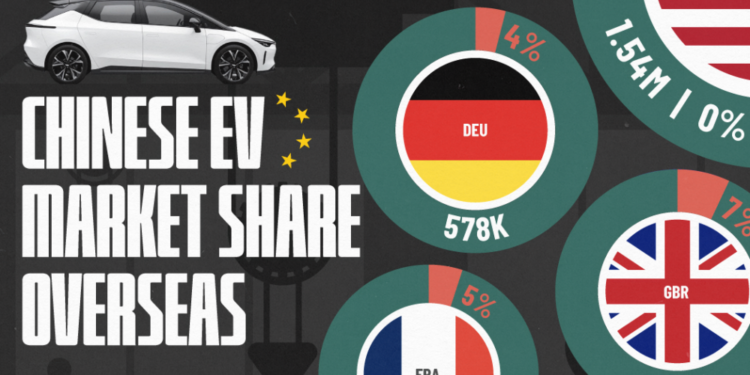

Having conquered the domestic market, Chinese luxury EV brands are now executing carefully planned global expansions, focusing initially on Europe and Southeast Asia.

1. Europe as the Key Battleground: Europe, with its environmentally conscious consumers and strong EV incentives, is the primary target. Brands like BYD, Nio, and Xpeng are establishing flagship showrooms in major cities like Berlin, Oslo, and Amsterdam. They participate in prestigious auto shows, highlighting their technology and design credentials to compete directly with Audi, BMW, Mercedes-Benz, and Tesla on their home turf. The value proposition is compelling: comparable or superior technology, luxurious appointments, and often a more attractive price point.

2. Overcoming Perceptions and Building Trust: The initial challenge is overcoming historical perceptions of “Made in China” as synonymous with low quality. Chinese automakers are addressing this head-on by achieving top scores in stringent Euro NCAP safety tests, offering industry-leading warranties, and emphasizing their cutting-edge manufacturing quality. They are building trust through transparency, stellar customer service in new markets, and letting the product’s performance speak for itself.

3. Innovative Sales and Service Models: Exporting their unique ecosystems, companies like Nio are building their battery-swap station networks and Nio Houses in Europe. This replication of the holistic Chinese model is a bold experiment to differentiate themselves beyond the metal of the car itself, offering a new paradigm of premium mobility service.

D. Technological Innovations Driving Competitive Advantage

The technical prowess of Chinese EVs is the bedrock of their appeal. Several areas stand out as key differentiators.

A. Battery Technology and Energy Management. Beyond manufacturing scale, Chinese firms lead in battery innovation. BYD’s Blade Battery uses lithium iron phosphate (LFP) chemistry arranged in a long, thin cell structure that increases structural rigidity and dramatically reduces the risk of thermal runaway (fires). CATL is pioneering condensed battery technology with even higher energy density. Sophisticated battery management systems (BMS) maximize range, longevity, and charging efficiency.

B. The Software-Defined Vehicle (SDV) Architecture. The true luxury in a modern EV is its software. Chinese brands treat the vehicle as a platform that continuously improves via OTA updates. These updates can unlock new features, enhance performance, refine ADAS capabilities, and refresh the user interface, ensuring the car evolves and remains fresh years after purchase. The deep integration of AI voice assistants, capable of controlling nearly every vehicle function, sets a new standard for convenience.

C. Powertrain and Performance Engineering. The inherent advantages of electric powertrains are being pushed to extremes. Multi-motor setups, as seen in the Yangwang U8, deliver hypercar-level acceleration (0-100 km/h in under 3 seconds) and novel driving dynamics like the tank turn. Advanced chassis control, incorporating air suspension and adaptive damping, delivers a ride quality that rivals or surpasses the most comfortable traditional luxury sedans.

D. Smart Cockpit and Immersive Experience. The interior is transformed into a “third living space.” Massive, high-resolution screens, passenger-side entertainment displays, augmented reality head-up displays (AR-HUD), and premium audio systems are standard. Features like massaging seats, advanced air purification, and customizable ambient lighting create a personalized, sanctuary-like environment.

E. Future Implications and Challenges for the Global Market

China’s dominance signals a historic power shift with wide-ranging consequences.

1. Intensified Global Competition and Potential Price Wars: The arrival of feature-rich, well-priced Chinese luxury EVs forces incumbent automakers to accelerate their own EV plans and reconsider pricing strategies. This competition will ultimately benefit consumers through more choice, better technology, and potentially lower prices, but it will squeeze profit margins for all players.

2. Reshaping the Definition of Automotive Luxury: The criteria for a luxury vehicle are shifting from legacy brand prestige, engine sound, and leather craftsmanship to seamless software, autonomous capability, cabin tech, and personalized digital services. Heritage brands must rapidly adapt to this new value system or risk irrelevance.

3. Supply Chain and Geopolitical Considerations: Dependence on China for batteries and critical minerals grants China significant geopolitical leverage. Other regions are scrambling to develop their own supply chains, but this will take years. Trade tensions and tariffs could become a significant barrier, potentially fragmenting the global EV market.

4. Sustainability and Lifecycle Analysis: As the volume grows, the full lifecycle environmental impact of these vehicles from mining of raw materials to battery recycling will come under greater scrutiny. Leading Chinese firms are already investing in closed-loop recycling processes, recognizing that true leadership encompasses sustainable stewardship.

Conclusion

China’s domination of the luxury EV sales charts is a testament to a perfect storm of strategic vision, industrial capability, and digital innovation. It marks the end of the era where automotive luxury was dictated solely by Stuttgart, Munich, or Detroit. Brands like BYD, Nio, Li Auto, and Xpeng are not merely copying existing paradigms; they are inventing new ones, centered on technological audacity, ecosystem integration, and user-centric design. Their rapid global expansion poses the most significant challenge to established automakers in a century. The race for the future of the automobile is underway, and for now, China holds a substantial lead. The question for traditional luxury marques is no longer if they must transform, but whether they can do so quickly enough to compete in this radically new landscape where software, battery, and intelligence are the ultimate arbiters of luxury.